Investment and research center, Take your practice to the next level with cutting-edge technology solutions.

Brooks Asset Management Limited System combines independent high-conviction decision-making with the diversity that comes from multiple perspectives. It has delivered long-term results that help clients pursue their goals.

Our portfolios house diverse

perspectives

We divide portfolios into segments, each run by an individual manager. The managers represent a diverse set of backgrounds, styles and approaches. Typically, each is personally invested in the portfolios they manage

Our portfolios feature high-conviction investments

While managers collaborate and share insights, each invests independently according to their strongest convictions. The resulting portfolios are a diverse collection of investment ideas, not just one manager’s perspective. This approach creates the potential for portfolios to fare well in a variety of market conditions.

Our investments are grounded in

fundamental research

Our investment analysts conducted more than 20,000 meetings with companies in 2020. Keeping in close contact with management teams and spending time on location, when possible, help drive deep operational understanding and informs all our investment decisions.

Our investment analysts do more than make recommendations

At most firms, analysts only recommend investments, but at Brooks Asset Management Limited they typically have the opportunity to actually invest in their highest conviction ideas. Most funds have research portfolios managed by analysts.

Our system provides management continuity and a consistent approach

Our multiple-manager system supports our commitment to investors with long-term goals. It has allowed us to navigate near-term noise and periods of economic and market uncertainty in pursuit of key goals..

Designed to help investors pursue

long-term investment success

We strongly believe long-term investing aligns with client goals, and our culture and compensation structure reinforce that focus. We typically hold investments significantly longer than our industry peers.

Brooks Asset Management Limited has generated strong performance since inception by consistently employing our long-term, concentrated, engaged value investment discipline. We apply the same in-depth, fundamental company research and rigorous security selection across all strategies. A key to our decades-long success has been our business ownership mindset that underlies our investment criteria of high-quality businesses, run by capable people, trading at a discounted price.

As long-term business owners – not traders or speculators – we can capitalize on the fear and greed that drive short-term market prices by investing with a five-plus year horizon, using objective intrinsic values.

We have maintained our long-term discipline since our inception, even as time horizons for most investors have moved meaningfully shorter. As long-term, bottom-up, fundamental business appraisers, volatility is our friend and enables time horizon arbitrage. Short-term market price dislocations give us the opportunity to own discounted, high quality businesses run by partners who compound long-term value, which are temporarily out of favor. Because Brooks Asset Management Limited is independent and employee-owned and our employees are collectively our own largest client, we can stick to our long-term discipline, even in times when it feels difficult to do so. However, it is not enough to be a long-term investor; you must also have a client base that will think and act long-term. We have aligned ourselves with our clients by investing alongside them in our funds, closing our strategies when it would benefit our shareholders to do so and maintaining an open dialogue over time. We are fortunate to have developed a strong base of likeminded, long-term, aligned clients who have allowed us to successfully pursue our approach .

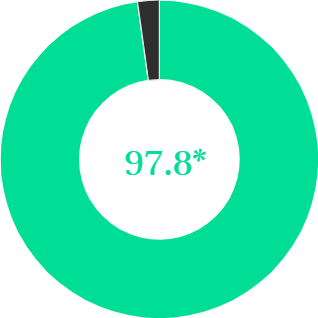

*Our high Active Share - defined as the percentage of fund holdings that is different from the benchmark holdings - reflects the truly differentiated nature of our portfolios.

We own what we view as the most qualified 18-22 global investments in each portfolio.

Concentrating allows adequate diversification while providing the opportunity to maximize returns and minimize loss. Most research shows

that holding 10-12 uncorrelated investments allows for adequate diversification. Owning 18-22 allows us to concentrate in our best ideas

while allowing for potential overlapping risk factors or correlations. Concentrating in our best ideas allows our global investment team

to form a deep understanding of each business through in-depth research and continual refinement of each case over time. We take a private

equity-like approach to vetting each business and engaging on an ongoing basis with our management teams.

Our concentrated approach also applies to how we run our business. We employ a single, consistent investment approach. We understand and

stick to our circle of competence and only seed new strategies when we find an opportunity set where we want to invest our own capital that

we cannot access in our current funds. We operate a team-driven structure. We have a concentrated research team of 15 generalists across our

three research offices. The team is deep and experienced enough to adequately cover the globe but nimble enough to effectively collaborate

across borders.

We view our portfolio company management teams and boards of directors as partners, and we constructively engage with them to help drive successful, long-term outcomes, using our global network, size and reputation.

We seek to partner with aligned management teams that have a track record of creating value for shareholders. We approach every investment with a business owner mindset, and we believe it is our fiduciary duty to always keep an engaged dialogue with our management teams and boards of directors. Even in cases where we are fully supportive of management, we are never passive. Our experience and reputation of being a large, long-term, collaborative shareholder gives us access to management and the credibility to share ideas and help effect positive outcomes. Our extensive global network, built over four decades, is a unique competitive advantage that allows us to evaluate businesses and management from multiple perspectives. We tailor our engagement in each country based on our on-the-ground experience and understanding of what is most effective in each region.

We are value investors and demand a wide margin of safety to minimize the risk of permanent capital loss and maximize return potential.

We believe that margin of safety is the driving force for long-term, intelligent investing, but cheap is not enough. Every business must meet our quantitative and qualitative criteria. We require a high-quality business and management because they increase the probability that the company’s future value per share will grow and that our outcome will be better than expected. We must purchase that quality at a discount to our appraisal value to have a margin of safety in the event of unexpected challenges in the unknowable future. Finding all three investment criteria – strong business, good people and discounted price – is extremely difficult.

Our 'hire' rated managers outperform their benchmark by an average of 1.62%.

These results are measured over rolling 5-year periods from the start of the millennium to the end of 2019.

On average, 79% of our 'hire' rated managers beat their benchmark.

Intelligently diversified

Our approach to asset allocation and diversification is based on one simple insight. No one asset class or style always outperforms. No single manager is great at everything. History repeats this story time and time again. This insight informs our diversified approach. Our expertise extends well beyond traditional stocks and bonds, with extensive expertise in non-traditional asset classes including infrastructure and private equity—over 170 asset categories in total. We draw on this expertise to design an asset allocation, stress-testing across 5,000+ possible scenarios to help ensure it offers the highest likelihood of reaching your goals.

BRINGING TOGETHER SPECIALIST EXPERTISE IN:

major asset classes

Factors

Sectors

Sub asset classes

Investment styles

14k+

THE POWER OF DIVERSITY

Bringing it all together The Brooks Asset Management Limited System builds portfolios that house multiple, disparate views. This diversity creates the potential for portfolios to fare well in a variety of market conditions.